Decline in Buyers Suggests That a Stock Market Crash Is Likely

Understand the basics: stock markets go higher as long as there are more buyers than sellers. If this equation changes even a bit, and you end up with fewer buyers and the same number of sellers, a stock market crash follows.

As it stands, we are seeing major buyers dissipate. With this, it’s important for investors to be very careful and pay close attention to this phenomenon.

Consider the companies traded on the key stock indices. They were the biggest buyers of their own stocks not too long ago. They spent their earnings to buy back shares. Low interest rates gave them an incentive to borrow money and buy back those shares.

Now we see them pulling back from buying their own shares.

Look at the S&P 500 companies: in the 12-month period ending on June 30, S&P 500 companies bought $500.8 billion worth of their own shares. In the same period a year ago, this amount was $585.4 billion. This represents a decline of 14.5% year-over-year. (Source: “Q2 2017 S&P 500 Buybacks Fall 9.8% from Q1, to $120.1 Billion,” PR Newswire, September 18, 2017.)

Going forward, it wouldn’t be shocking to see companies on the key stock indices pulling back further on their stock buybacks. Why? Because interest rates are increasing. It would be a very bad business decision to borrow money to buy stocks as costs are increasing. When rates were kept artificially low by the Federal Reserve, it slightly made sense. Not anymore.

Money Managers Ditching Stocks

Here’s the thing, companies traded on the major indices aren’t the only buyers that are dissipating.

Look at the so-called Smart Money as well: institutional investors. It seems that they don’t like stocks whatsoever. In fact, it looks like they might be getting some sort of a stock market crash head.

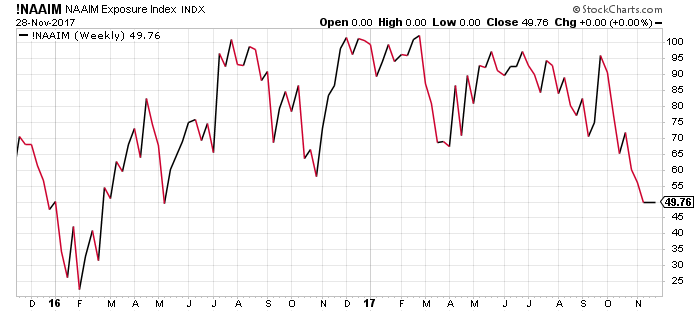

Please see the chart below. It’s the National Association of Active Investment Managers (NAAIM) Exposure Index. This index basically tells us what percentage of active managers’ portfolios consists of stocks.

Chart courtesy of StockCharts.com

Stocks make less than half of active managers’ portfolios. These managers had a sudden change of heart recently. In early October, their portfolios were near 100% stocks. Their stock holdings stand at their lowest level since March 2016. This was just after the sell-off that occurred in early 2016.

What’s Next for the Stock Market?

Dear reader, it is very easy to get lured into the idea that all is well and that there’s not much to worry about.

Do I think the bull market is about to end? I can’t predict tops and bottoms. But, looking at how the buyers are dissipating, my conviction is that we may be closing in on a top, rather than being on the cusp of a major upside move.

Key stock indices like the S&P 500 have soared close to 300% since the stock market crash of 2008–2009. With this in mind, I have constantly been asking one question, which I will ask again: Could the index increase 300% from where it currently stands without any sort of pullback? For the S&P 500 to increase 300% from current levels, it would have to soar to roughly 7,878. Do you see it happening in the next eight to nine years?